How to Start Investing in Real Estate This Year

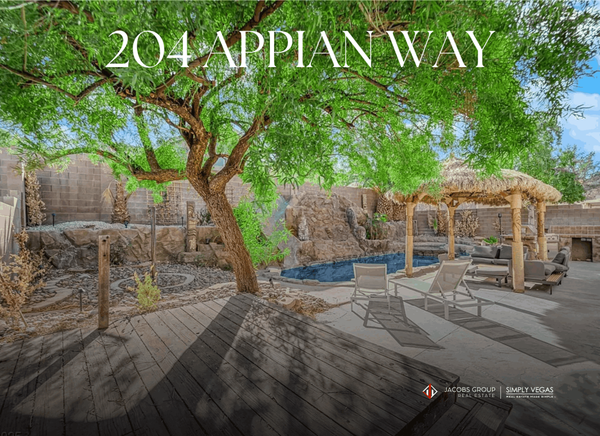

by Jacobs Group Vegas

Real estate has long been considered one of the most reliable ways to build wealth. With the potential for steady cash flow, appreciation, and tax benefits, it’s no wonder many people want to dive into property investing. However, getting started can feel overwhelming if you don’t know where to begin. The good news is that with some research, planning, and action, you can take your first steps toward real estate investing this year. Here’s how to get started.

1. Define Your Investment Goals

Before diving into real estate, it’s essential to determine what you hope to achieve. Are you looking for a steady passive income, long-term wealth building, or a mix of both? Your goals will help guide your strategy. For example, if you want immediate cash flow, you might focus on rental properties. If you’re more interested in long-term appreciation, buying and holding properties in growth markets may be a better fit.

Ask yourself:

-

How much risk am I willing to take?

-

How much time and effort can I dedicate?

-

What kind of returns am I aiming for?

Having clear goals will set the foundation for your investment journey.

2. Educate Yourself

Real estate investing requires a solid understanding of the market and its dynamics. Take the time to learn about different investment strategies, such as:

-

Buy and Hold: Purchasing properties to rent out for ongoing income.

-

Fix and Flip: Buying undervalued properties, renovating them, and selling them for profit.

-

Wholesaling: Finding properties at a discount and selling them to other investors for a fee.

-

REITs (Real Estate Investment Trusts): Investing in real estate through publicly traded companies.

Read books, attend seminars, or listen to podcasts focused on real estate investing. Networking with experienced investors can also provide valuable insights and guidance.

3. Assess Your Finances

Real estate investing often requires upfront capital, so it’s important to understand your financial situation. Start by reviewing your credit score, savings, and debt levels. A strong credit score will help you secure better loan terms if you’re financing your investment.

Consider how much money you can comfortably invest without jeopardizing your financial stability. Keep in mind there are costs beyond the purchase price, such as:

-

Down payment (typically 20-25% for investment properties).

-

Closing costs.

-

Maintenance and repairs.

-

Property management fees (if you’re not managing it yourself).

If you’re short on funds, look into alternative financing options like partnering with other investors or exploring private loans.

4. Research Markets

Location is one of the most critical factors in real estate investing. Research markets that align with your goals, considering factors like:

-

Population growth.

-

Job opportunities.

-

Rental demand.

-

Property values.

Emerging markets with affordable prices and high growth potential often provide the best opportunities for new investors. Use online tools, local real estate agents, and market reports to gather data.

5. Choose Your Investment Strategy

With your goals, knowledge, and market research in place, decide which investment strategy works best for you. For beginners, starting small is often the safest route. Consider:

-

House Hacking: Buying a multi-family property, living in one unit, and renting out the others.

-

Single-Family Rentals: Easier to manage and typically lower-cost compared to multi-family properties.

-

Turnkey Properties: Ready-to-rent properties that require minimal effort upfront.

Focus on one strategy to start, and expand as you gain experience.

6. Build Your Team

Real estate investing is rarely a solo effort. Surround yourself with professionals who can help you succeed, such as:

-

Real estate agents familiar with investment properties.

-

Mortgage brokers or lenders.

-

Property managers.

-

Contractors for repairs and renovations.

-

Accountants and attorneys for legal and financial advice.

Having a reliable team will make your journey smoother and reduce costly mistakes.

7. Take Action

The most important step is to start. Many aspiring investors get stuck in the research phase, afraid of making mistakes. While it’s important to be informed, you can’t learn everything upfront. Start small, be prepared to learn as you go, and remember that every successful investor started where you are now.

Start by identifying a potential property, running the numbers to ensure it meets your financial goals, and making your first offer. Use tools like the 1% Rule (monthly rent should equal at least 1% of the purchase price) or cash-on-cash return calculations to evaluate deals.

8. Monitor and Adapt

Once you’ve purchased your first investment property, the work doesn’t stop there. Monitor your investment’s performance regularly and adapt to market changes. If things don’t go as planned, learn from the experience and apply those lessons to your next deal.

Conclusion

Real estate investing can be a powerful way to build wealth, but it’s not a one-size-fits-all journey. By setting clear goals, educating yourself, and taking strategic action, you can begin your real estate investing journey this year. Remember, the key is to start small, learn from your experiences, and build your portfolio over time. With persistence and the right approach, you’ll be on your way to achieving your financial goals through real estate.

Categories

Recent Posts

GET MORE INFORMATION