Real estate investing can be incredibly rewarding—but only if you know how to properly evaluate a deal. Whether you're considering a rental property, a fix-and-flip, or a long-term investment, understanding the key metrics and strategies used by professional investors is essential. Here's how to analyze a real estate deal like a pro:

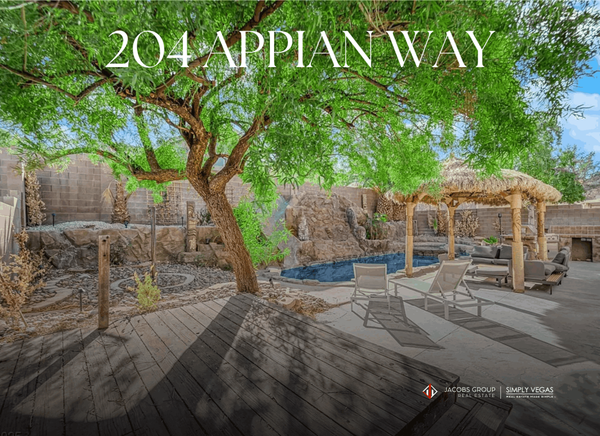

1. Start with the Location

The old saying “location, location, location” still holds true. Even the best property can underperform in a poor location. Evaluate:

-

Neighborhood desirability (school district, safety, walkability)

-

Proximity to jobs, transit, and amenities

-

Market trends: Is the area appreciating or declining?

Researching local comps (comparable sales or rentals) helps determine whether the location supports your investment goals.

2. Run the Numbers: Cash Flow and Expenses

The foundation of any good real estate deal is positive cash flow—meaning the property generates more income than it costs to operate.

Here’s a basic formula:

Net Operating Income (NOI) = Gross Rental Income – Operating Expenses

Operating expenses include:

Once you calculate your NOI, subtract your mortgage payment to determine your cash flow. A pro looks for consistent, positive monthly cash flow that cushions against vacancies or unexpected costs.

3. Understand Key Metrics

To dig deeper into the deal, here are three metrics the pros always use:

-

Cap Rate (Capitalization Rate)

Formula: NOI ÷ Purchase Price

This tells you the return you’re getting on the property itself, without financing. A 6%–8% cap rate is common in many markets.

-

Cash-on-Cash Return

Formula: Annual Cash Flow ÷ Total Cash Invested

This shows your return based on how much money you actually put in (down payment, closing costs, rehab). It's essential for leveraged deals.

-

Gross Rent Multiplier (GRM)

Formula: Purchase Price ÷ Gross Annual Rent

A quick way to compare deals—lower GRMs often signal better value.

4. Factor in Appreciation and Tax Benefits

While cash flow is crucial, don’t ignore long-term wealth builders:

-

Appreciation: Will the property increase in value over time?

-

Mortgage Paydown: Tenants pay down your loan balance, increasing equity.

-

Tax Advantages: Depreciation and expense deductions can significantly reduce taxable income.

These elements can turn a break-even deal into a big win over time.

5. Stress-Test the Deal

Before pulling the trigger, analyze the worst-case scenario:

-

What happens if rent drops by 10%?

-

Can you cover expenses if there's a vacancy for two months?

-

Are there upcoming repairs or renovations needed?

A pro doesn’t just plan for the best—they prepare for the unexpected.

Final Thoughts

Analyzing a real estate deal like a pro isn’t about taking risks—it’s about making informed decisions based on solid numbers and market knowledge. By doing your homework, using the right metrics, and planning for contingencies, you can build a profitable and sustainable investment portfolio.

Ready to run numbers on your next deal? Let’s connect.